new haven county property taxes

We Provide Homeowner Data Including Property Tax Liens Deeds More. The mission of the Assessors office is to discover list and value all real estate business personal property and motor vehicles to establish a fair and equitable distribution of the local property tax burden.

Welcome To Montgomery County Texas

Ad Searching Up-To-Date Property Records By County Just Got Easier.

. These buyers bid for an interest rate on the taxes owed and the right to. PAYMENTS MADE IN. The median property tax also known as real estate tax in New Haven County is 462100 per year based on a median home value of 27330000 and a median effective property tax rate of 169 of property value.

Search Any Address 2. New Haven County collects very high property taxes and is among the top 25 of counties in the United States ranked by property. AS OF NOVEMBER 162015 THE DMV NO LONGER ACCEPTS PAPER TAX RELEASES.

The mill rate for the 2020 Grand List is 4388. Get In-Depth Property Reports Info You May Not Find On Other Sites. Get Record Information From 2021 About Any County Property.

These records can include New Haven County property tax assessments and assessment challenges appraisals and income taxes. Tuesday Wednesday Thursday and Friday 8 am. DMV Property Tax Unit.

New Haven County has one of the highest median property taxes in the United States and is ranked 39th of the 3143 counties in order of median. ALL outstanding vehicle taxes associated with your name andor VINplate including taxes not yet delinquent must be paid in full for a release to be issued. New Haven County Property Records Search Links.

Editors frequently monitor and verify these resources on a routine basis. Ad Uncover Available Property Tax Data By Searching Any Address. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in New Haven County CT at tax lien auctions or online distressed asset sales.

Home Shopping Cart Checkout. The New Haven County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within New Haven County and may establish the amount of tax due on that property based on. New Haven County collects on average 169 of a propertys assessed fair market value as property tax.

Account info last updated on Mar 24 2022 0 Bills - 000 Total. ALL outstanding vehicle taxes associated with your name andor VINplate including taxes not yet delinquent must be paid in full for a release to be issued. IMPORTANT DMV RELEASE NOTICE.

The City of New Haven. New Haven County Assessors Office Services. The City of New Haven has hired Vision Government Solutions Inc to conduct the.

See Property Records Deeds Owner Info Much More. Therefore a property assessed at 10000. New Haven County Connecticut.

DMV DELINQUENT TAX RELEASE. Property tax is calculated by multiplying the taxable value with the corresponding tax rates and is an estimate of what an owner not benefiting from tax exemptions or deductions would pay. New Haven County CT currently has 888 tax liens available as of March 25.

The New Haven County Property Records Search Connecticut links below open in a new window and take you to third party websites that provide access to New Haven County public records. Click here for a. A mill rate of one mill means that owners of real personal and motor vehicle property are taxed at a rate of 1 on every 1000 of assessed taxable property.

New Haven County Property Tax Payments Annual New Haven County Connecticut. City Of New Haven. 165 Church Street New Haven CT 06510.

View Cart Checkout. Will pay a tax of 43880. Property Taxes No Mortgage 382955200.

The DMVs Property Tax Section may be reached by mail at. Or by phone at 860 263-5153. New Haven County Property Tax Collections Total New Haven County Connecticut.

Then a hearing concerning any planned tax increase has to be convened. The median property tax in New Haven County Connecticut is 4621 per year for a home worth the median value of 273300. Property Taxes Mortgage 846861200.

New Haven County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in New Haven County Connecticut. The Mill Rate for the 2020 Grand List is 4388. If New Haven County property tax rates are too costly for your revenue resulting in delinquent property tax payments a possible solution is getting a quick property tax loan from lenders in New Haven County CT to save your property from a potential foreclosure.

New Haven County Property Tax Payments Annual New Haven County Connecticut.

Connecticut State Parks Adventure Planning Journal Adventure Planning State Parks Adventure Destinations

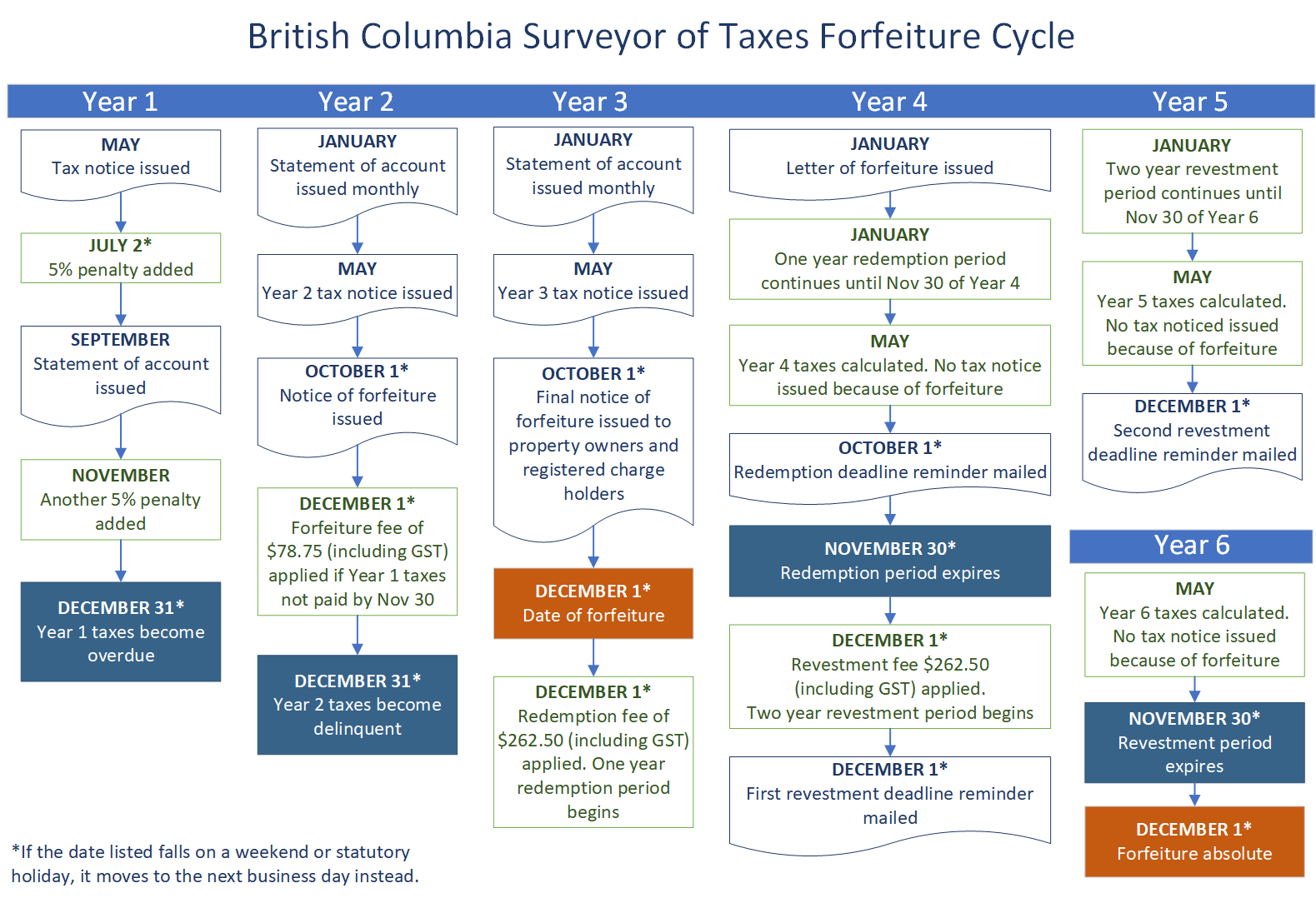

Overdue Rural Property Taxes Province Of British Columbia

Downsizing In 2020 Downsizing Home Hacks Canning

How To Assess A Real Estate Investment Trust Reit Real Estate Investment Trust Investing Real Estate Investing

City Of Reno Property Tax City Of Reno

Live And Invest In The Dominican Republic Conference May 17 19 2017 Investing Dominican Republic Expat

Real Estate And Personal Property Tax Unified Government Of Wyandotte County And Kansas City

Property Taxes Department Of Tax And Collections County Of Santa Clara

Worst Counties Map Amazing Maps Imaginary Maps Cartography Map

The Best Place To Retire Isn T Florida Best Places To Retire Retirement Locations Retirement

How Will The Irs Contact Me Amy Northard Cpa The Accountant For Creatives Small Business Tax Deductions Business Tax Deductions Small Business Tax

Homestead Exemption How To Apply Homeowner Homesteading

Property Taxes Department Of Tax And Collections County Of Santa Clara

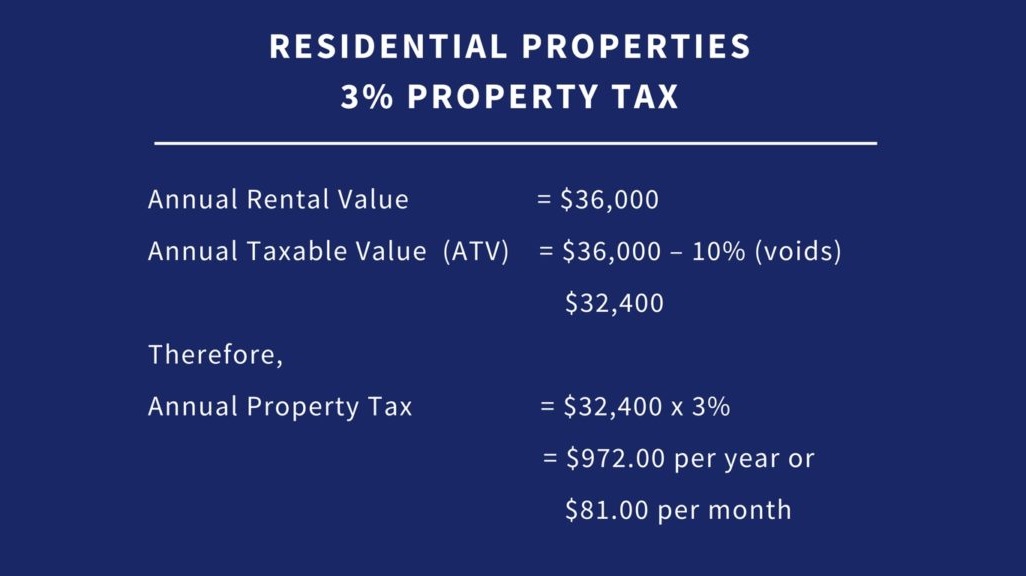

Updated 10 Things To Know About Property Tax Loop Trinidad Tobago

Offshore Banking Singapore Offshore Bank Banking Banking Services

Is Panama A Tax Haven For You It Could Be So Learn Some Facts Tax Haven Tax Time Private Limited Company

Why People Love Living In New Haven Winchester Lofts New Haven Architecture Details Brookfield